Amazon Accounting

Before we get started, here’s an important disclaimer:

These are tips, tricks, and tactics employed by many successfully Amazon sellers to help simplify their accounting processes.

We cannot give specific accounting recommendations. Please work with your CPA or tax attorney for appropriate tax, accounting, or legal advice.

We are going to assume that you are properly versed in accounting and will therefore be providing information meant to help you make your Amazon accounting more efficient.

For those of you new to business or to accounting, you can start by reading through our crash course in accounting video.

That will help you understand the basics, but that probably won’t be enough. You need to read some books on accounting,

Take a class, and shadow someone with some real know-how to gain the level of financial competence to make the necessary and sophisticated business decisions that will determine, ultimately, whether you fail, mildly succeed, or thrive.

Business Accounting Reports

In this section we’ll review the different reports you’ll need to generate for bookkeeping & managerial purposes. We’ll cover payment, inventory & sales reports.

We’ve provided a document outlining the steps to generate each of these reports for you entitled “Amazon accounting reports”.

Note that some reports can take up to 1 hour to generate. If you do not see your report right away, check again later.

Payment Reports

These reports either summarize or breakdown the sales you made, fees you incurred, and the money Amazon ultimately paid you:

- Statement view report

- All statements report

- Date range reports

- The transaction view report

Inventory Reports

You’ll probably get more granular data for FBA inventory using these FBA reports than your own accounting software.

Consider that your inventory data in your books usually won’t reflect what is inbound to Amazon, what is missing, what is reserved or being transferred from one warehouse to another, and even what is damaged.

It is possible to account for these differences, but it’s a tedious process to update continually. For bookkeeping purposes, most sellers only update this type of information annually, for tax purposes.

Although, it’s difficult and usually unnecessary to keep this information constantly updated in your books, it is readily available in seller central, and should be accessed regularly so you remain aware of your inventory position.

It’s natural to go to the inventory tab for your inventory-related reports, and there are a lot of reports available within the inventory tab, underneath inventory reports.

While these reports can each serve specific purposes to inventory management, we have found for accounting purposes, this section provides little benefit. Many reports provide only partial data for accounting needs.

We recommend using the “inventory health” and “manage FBA inventory” reports.

To navigate to these reports, click on the reports tab, then fulfillment. Within the inventory section of the left-hand tab, click on show more… (directly underneath the inventory event detail link).

The inventory health report provides a viewable and downloadable report of all of your inventory, while the manage FBA inventory report is only available for download and includes a report of all of your FBA inventory.

Many sellers with less than 50 SKUs use the manage FBA inventory screen (within the inventory tab) instead of pulling the manage FBA inventory report.

Sales Reports

Whereas the other reports we’ve covered look more like your bank statement, this reporting section aligns closely with google analytics in look, feel, and real-time sorting capabilities.

To navigate to your sales reports, go to the reports tab and click on business reports.

This will default to your sales dashboard showing today’s sales (and yesterday’s, and the same day last week, and the same day last year) each by hour.

You can apply many filters here to produce reports by day, week, month and year. You can also filter by product categories and fulfillment method.

The default viewing window from the dashboard will be a graphical display. Comparing sales between current and previous timeframes or spotting seasonal trends is quick and easy with the graphs.

To view this data as a list, you can select table view in the top right corner of the compare sales section. At any time, whether in graph or table view, you can click on download in the top right corner of the dashboard, and you’ll download a csv table of the data currently displayed according to the filters that you have set or have been automatically set.

That’s just the beginning though. The real meat of the business reports section is below the dashboard link in the section entitled business reports.

All of the reports in this section are available for display and for download.

Sales Report Filter

By Date

Each row will show a different day (week or month, depending on your view selection) with your SKU data aggregated. In this format, your figures for all of your items are lumped together, including stats like buy box percentage, average selling price, and average offer count. This report can be very useful when looking at overall account performance for a given period.

Within the by date section there are subsections of:

- Sales and traffic

- Detail page sales and traffic

- Seller performance

Let’s examine a few key terms: sessions and page views. Amazon defines a session as a customer visit to an Amazon.com page. That “visit” lasts for 24 hours in Amazon’s calculation, meaning that, even though a customer views a number of pages multiple times (within 24 hours), it will all be considered as one session. Whereas, page views are the actual number of times a customer visited a page. In one session, a customer can have multiple page views. As a result, your reports may show a more page views than sessions.

By ASIN

These reports provide analytical data such as sessions, page views, buy box %, units ordered, ordered product sales, etc.

Data for these reports is generally available for up to two years. Within the by ASIN section there are subsections of:

- Detail page sales and traffic

- Detail page sales and traffic by parent item

- Detail page sales and traffic by child item

These reports can be viewed on screen and filtered by data in the top right corner or downloaded in csv format from the top left-hand corner.

These are valuable reports as they provide granular data for assessing SKU-level figures for sessions, page views, buybox percentage, units ordered, and other figures.

Brand performance

This section provides performance by SKU data for customer reviews received, average customer review ratings, sales rank, buy box percentage, and missing image indicator.

It can be viewed on screen or downloaded for mass sorting and pivoting purposes. Don’t underestimate the value of this report. You should build into your systems so it’s viewed along with your sales reports.

Listings With Missing Information

The listings with missing information report, under other, takes you to the manage inventory tool. In manage inventory, you will find a variety of filters to identify listings that are incomplete or contain incorrect information.

Inventory In Stock

Takes you to the Amazon selling coach section and provides metrics to help you stay in stock on each ASIN.

How To Track FBA Inventory In Your Books

For sellers who utilize the fulfillment by Amazon service for a portion of their products, accounting for inventory stored at Amazon’s fulfillment centers can be tricky, especially if they have their own warehouse locations.

We will cover some popular methods which sellers use to track or account for FBA inventory within their accounting system.

One method for tracking the allocation of FBA inventory within your accounting system to Amazon, is to create a sales order to Amazon to deduct that inventory from your available inventory quantities in your books. Purchase orders are subsequently created from data extracted in your Amazon payment reports. In other words, after product is sold and money is paid to you from Amazon, you will use their payment statement to generate your own invoice from your sales order. You’ll then receive payment against that invoice when funds are actually deposited into your bank account.

Advantages

This method more closely aligns with reality because all of the inventory on that sales order is in Amazon’s possession but has not been sold through the channel yet. This allows you to deduct what you have shipped to Amazon from your available inventory quantities in your books without recording sales. It also gives you the ability to create invoices from the sales order using Amazon’s payment reports which updates sales figures to your books and automatically changes the inventory balance on the sales order reflecting the remaining inventory at Amazon which has not been sold.

Disadvantages

You have to update the sales order or create new ones for additional items sent to Amazon. It can be difficult to create purchase orders to match items sold from multiple sales orders. Although QuickBooks and many other accounting software applications use sales orders in this manner, not all accounting systems do – some only have sales receipts, which is very different from a sales order.

This process can confuse inexperienced bookkeepers and can be time consuming if you send a lot of shipments to Amazon.

Additional Warehouse Inventory Accounting

The most popular method for tracking FBA inventory in your books is to move/transfer that inventory to an FBA warehouse (or warehouse #2, or Amazon warehouse, whatever label you choose to assign to that additional warehouse location)

Advantages

Allows you to deduct from your available inventory quantities in your books. No need for messing with sales orders. Quicker than the sales order method.

Disadvantages

You now have to manage an additional inventory location within your accounting software.

You have many different classifications of inventory within FBA (fulfillable, unfulfillable, reserved, receiving, in-transit, etc.) And they each change constantly. Trying to match these classifications may not be possible or may be time-intensive. Also, not all accounting software applications allow for multiple warehouse locations. In fact some of the most popular web-based accounting software does not allow this.

Non-Inventory Accounting

Because Amazon keeps detailed records on inventory (daily and monthly inventory amounts), many FBA sellers have reconsidered entering all that detail into their accounting programs and have elected to not track individual inventory assets in their books. (we will cover this in detail in the next section)

Cash Vs Accrual Based Accounting For Amazon Sellers

As a disclaimer, we’re not recommending the cash or accrual accounting method for your business. Talk to your CPA about that choice.

We can tell you though that many experienced sellers utilize a “blended” approach by not continually tracking inventory in their books.

They do perform reconciliations using the Amazon FBA inventory reports and enter the inventory asset value at the end of each designated period (i.e. monthly, quarterly, annually).

This does not mean it’s incorrect to enter every transaction and inventory value from purchases into your books.

That’s how many businesses do it, but others have found a more efficient way for booking their Amazon sales that still satisfies tax requirements.

They, alternatively, choose to use tools outside their books to monitor, analyze, and manage their inventory and unit sales.

Blended Tactics

We’ve worked with many sellers who have grown exponentially in a year’s time (from 800 average monthly orders to 8,000 average monthly orders) and have had trouble finding an efficient and reliable method of inputting Amazon sales data into their accounting software.

For example, one electronics seller was downloading bi-weekly Amazon settlement reports and extracting the data from there and creating one sales receipt into QuickBooks. It was confusing at times since there are so many random fees, refunds, reimbursements, etc. That he sometimes doubted whether he inputted all the correct information from the spreadsheet into his books. Also, since his settlement reports were every two weeks, he noticed that his last settlement report for the fiscal year actually extended into early January of the next year which caused him to include sales from a few days of January on his taxes.

He now uses a non-inventory item type, meaning the items are not tracked as an asset. So, technically, the items are expensed as soon as they are received. The inventory reconciliation he performs annually decreases the cost of goods sold and increases the inventory asset to match what he has in-stock at the end of the year.

Popular Blended Methods

Let’s review how these sellers account in a blended fashion.

- How to enter inventory – you can:

- Record the purchase of your inventory as an expense for a non-inventory item or

- Record the purchase of your inventory as cost of goods item tied to your Amazon sales income

- How to enter income – you can:

- Record one lump-sum payment from Amazon as Amazon sales income or

- Make out a sales receipt for Amazon product sales showing the total # of items sold without differentiating those items. Or

- Create a bank for Amazon funds and transfer the amount paid to you by Amazon to your account every time there is an Amazon settlement. Or

- Enter Amazon settlements as they occur, summarized by major account category: principal, shipping, shipping tax, tax, etc. (import the settlement data into excel, then summarize the data using a pivot table)

then use the “make deposits” function in your accounting software and enter the 10 or so account categories from the excel pivot table.

- How to enter Amazon fees:

- The Amazon expense total is all just one expense or

- You can summarize fees by major account category:

- Amazon commission, shipping chargeback, refunds, FBA fees, shipping to FBA, etc. Or

- List all fees as an expense for Amazon fees that go under commissions.

Use refunds to issue a refund, create a customer “Amazon customer” and make all Amazon sales under this customer. Or - Don’t record any Amazon expenses – just enter the net received payment as the income from Amazon

Transaction Detail Methods

If you are required to input every transaction detail into your accounting system there are three options:

- Input by hand: export the transaction detail report and enter individual orders and individual inventory into your spreadsheet or your accounting software. Create expense items for the different fees that Amazon charges (FBA fees, return fees, shipping to Amazon, disposal fees, monthly service fee, inventory storage fee, etc.) And enter these as well.

- Export files and convert to a format that can be imported to your accounting software

- Use a software program to automatically sync your Amazon transactions with your books

Managing Purchases

We won’t review the basics of how to create pos and item receipts; however, we will mention that many sellers use non-inventory (non-asset) items for this process as well.

They update the true inventory asset value on an annual basis for tax purposes.

Sales Tax

As a seller you are responsible for collecting sales tax on orders from for which you have a sales tax nexus or obligation.

We’ll discuss what exactly that means in a few minutes. Let’s start off with some basics:

Getting a sales tax permit

When you register your business with your state you should have the option to obtain a sales & use tax number. If you did not obtain this during your initial registration process, use your state government website to obtain a sales tax certificate and number.

Paying sales tax

After obtaining a sales tax number you should be assigned by your state government to pay either monthly, quarterly, or annually. This is usually determined by the expected sales volume figure you were required to enter during registration. The lower the number the more likely, you will file quarterly or annually. Filing requirements change based upon how much sales tax you collect. More collections lead to more frequent payments.

Common Misunderstandings

Now let’s address some common misconception from new sellers about how this process works. We have heard a number of uniformed sellers claim that “if you have setup your sales tax information correctly with seller central, then Amazon takes care of collecting and paying the sales tax”.

The reality is that this is unquestionably incorrect information–Amazon doesn’t pay the sales tax if you sign up for their collection service, they simply collect sales tax payments on your behalf for the tax jurisdictions you have a nexus in.

Sellers are still required to track, report and pay sales taxes–all Amazon does is pass the sales tax money through to the seller (for a cost mind you).

Let’s address another misunderstanding about where you collect sales tax. Many new sellers believe that you only collect state sales tax for locations where the sale is shipped to within the state in which your business is located. Unfortunately, this is also incorrect. You not only have to collect and pay sales tax where you are ‘domiciled’ but you also have to collect and pay sales tax for states in which you have a nexus

In other words, you don’t have to be the resident of a tax jurisdiction but may still have tax liability to that jurisdiction if you have a significant presence/connection in that area.

For example, if you reside in CA, but have an office in NY, then you are subject to taxes for purchases made in CA and NY. Even having inventory housed in another state can be considered nexus.

Tax Nexus

Each state has a slightly different definition of nexus, but most of the time, a state considers a “physical presence” as creating nexus.

Physical presence can mean a number of things, including having in that state:

- An office

- An employee

- A call center

- A warehouse

- An affiliate

- Storing inventory (even in someone else’s warehouse like FBA)

- Drop shipping from a 3rd party provider

- Temporarily doing physical business in a state for a limited amount of time, such as at a trade show or expo

While working with drop-shippers in other states, and shipping your products to FBA facilities in other states may cause tax nexus implications, you should talk with your tax attorney to figure out:

- If there is a tax implication to your business, and

- Whether that tax implication is something you plan to address

Today, even very large sellers on Amazon are awaiting a national sales tax resolution in order to address the tax implications from FBA and drop-shippers, as the operational difficulties of tracking such orders have caused some sellers not to recognize/address tax nexus from those two types of business.

While we neither agree nor disagree with such an approach, we acknowledge that FBA and drop-shipping cause rather complicated tax issues that will hopefully get simplified soon across states.

Collecting The Taxes

You’ve determined that you have sales tax nexus in a few states. What does that mean? What must you do now? If you have sales tax nexus in a state, then you must collect sales tax from buyers in that state and pay tax to that state on a regular basis, as determined by the state. If you decide not to ask Amazon to collect the state tax, you still have to pay it. And today, Amazon is charging roughly 2.9% of the tax collected as a fee for collecting the tax…so remember, if Amazon doesn’t collect it, you still have to pay it which means you will be out of pocket on sales tax.

This means you must determine the sales tax rate in that state, plus any local sales tax that might apply. Sales tax rates will vary from by locality. For example, the sales tax rate in Beverly hills (90210) is 9%. That 9% total includes a California state tax rate of 6.5%, plus a los Angeles county tax rate of 1% and a district tax rate of 1.5%.

2 Types Of Sales Tax

States have two types of sales tax to be aware of:

- origin-based sales tax states are fairly simple. You charge the amount of state and local sales tax as determined by your business’ location. Everyone who you ship taxable items to in that state pays the same rate. Your business’ location would be your office, warehouse, fulfillment center housing your inventor, or whatever is giving you a physical presence in that state.

- destination-based sales tax states are trickier. You must calculate and collect the sales tax rate wherever your buyers are located. This means you would charge and pay multiple sales tax rates within a single state.

Many software applications help you calculate the correct amount of sales tax to charge, but it’s ultimately up to you to ensure you are charging the correct amount.

For clarification’s sake let’s take the following question:

I’m an FBA seller. Does my inventory in Amazon’s various warehouses mean I have nexus in other states?

The short answer is unfortunately yes.

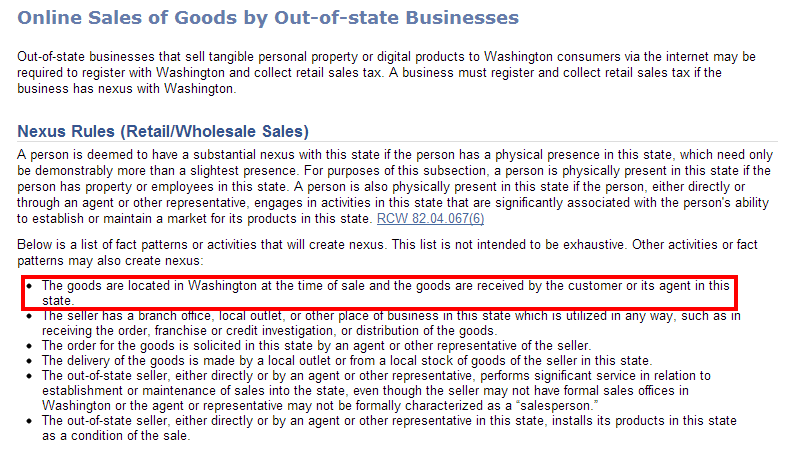

Have a look at what the state of Washington says about your inventory and sales tax:

Most of the nexus states say something similar to this.

Does Nexus Ever End?

If you no longer have inventory stored in a nexus state, do you still have a nexus tax liability there?

The answer is, again, yes. Once you have established nexus in a state, your business officially has nexus until you notify that state that you are no longer doing business there.

For FBA sellers, we recommend against this when you simply don’t have any inventory in a state for a while.

You would have to officially terminate your nexus relationship with that state, and once you have inventory end up again in that state’s fulfillment center, you’ll have to file for a new sales tax permit.

It doesn’t make sense unless you know for certain that you won’t have inventory again in that state.

Amazon’s Tax Collection Services

So, let’s say as an FBA seller with product stored in Amazon’s Washington based fulfillment center, you register for a sales tax permit, knowing that you will have nexus in Washington and will need to collect and pay sales tax in order to comply with the state’s tax laws.

What happens when a product is purchased and shipped to a customer in Washington from a fulfillment center in another state? Will you still need to have Washington state sales tax collected? Would Amazon even know to collect sales tax in this instance?

It may seem confusing, but you can trust the tax collection system with Amazon seller central. If your account is setup to collect sales tax in Washington state, Amazon will collect sales tax on any valid orders from customers in Washington. This includes orders which are sent from fulfillment centers in other states to customers in Washington state.

Remember though, that even if you sign up for Amazon’s tax collection service, you must still pay the tax to the appropriate state tax authority.

Income Taxes & Accounting Software

Income Taxes

Amazon will usually send you a 1099k after the end of the year, usually sometime in late January. This report is also available for download in seller central.

The 1099k figure is unadjusted gross sales. That means total Amazon sales unadjusted for fees, rebates (in the case of FBA) and refunds. It also includes gift wrap and shipping charges.

Don’t panic if this number doesn’t even match your accounting records because you only record what Amazon actually pays you as revenue.

As the seller, you must go through your records and make the necessary adjustments for tax purposes. Hint: unadjusted gross sales minus payment disbursements will give you a figure you can work to determine expenses.

The unadjusted gross sales figure is also based off shipment date, not sales transaction date. If the item sold Dec. 30, 2014, and ships Jan. 2, 2015, the sales figure will show on the 2015 report not the 2014 report.

Below is the IRS 1099k info link. It helps to understand why the number is what it is, and why it’s so important to understand your costs to get the net revenue and not freak out over the high gross on the 1099k–it’s basically every electronic cc transaction and ach transfer that Amazon did on the seller’s behalf–and to reiterate it does not account for any order refunded–you need to manually back those out:

Http://www.irs.gov/pub/irs-pdf/i1099k.pdf

Accounting software

There are a number of tools which sellers use to track, manage, and import Amazon payments and expenses to their accounting software.

While we won’t go into detail about any of these applications, we do provide a list of these companies and their software tools for you to learn more about and see if they can be of a benefit to you.

Keep in mind that seller central reports don’t naturally integrate in QuickBooks, Peachtree or other popular accounting software packages.

It will take some manual manipulation of the data you export in order to import or manually enter the data into your books.

The other option is to utilize a bridge program to gather that data from seller central and import it into your books.

Be careful though, as your imports may not align perfectly, so you should double check data that’s been synced to your books through a 3rd party program.

Inventory software

Check out these software applications to help you with your accounting for your Amazon business

- Inventorylab

- Outright (GoDaddy bookkeeping)

- QuickBooks online & QuickBooks desktop

- Stitchlabs

- Teapplix

Sales tax software

Check out these two main software applications to help you with your sales tax for your Amazon business:

- Avalara

- Taxjar