By Paul Faguet, Sellerscale

Whether Amazon is your only channel, or part of a multi-channel strategy, it’s critical to understand the financial health of your business and react rapidly to changes in the marketplace. This is easier said than done, however, because accounting on Amazon is inherently challenging. Complex selling fees, disjointed Amazon reports, bi-weekly payouts that are hard to tie back to specific SKUs, long lead times that complicate cash flow management… These are just some of the factors that make it hard to track your financial performance and complicate your decision-making as an Amazon merchant. In this article, we’ll cover the two main forms of accounting you’ll need to master to maximize control and profitability of your Amazon operation, and share some software tools you can use to make your accounting work a little easier.

Financial Accounting: Great for Reporting, But Not Decision-Making

Financial accounting is what most people probably think of when they hear the term “accounting.” Financial accounting is the summary, analysis, and reporting of financial transactions related to your business for public consumption—and it’s an absolute must for any serious business. However, financial accounting has several fundamental limitations that make it insufficient for comprehensive financial management of your Amazon operation.

Financial Accounting Limitation #1: It’s for Outsiders

First, the main purpose of financial accounting is to inform outside stakeholders, such as creditors, investors, and regulators—not to inform decision-making inside the business. That is why financial accounting is generalized, instead of specialized in a particular domain like the Amazon channel. So if you need to analyze the performance of an ad campaign or the unit economics of a particular SKU, you won’t get that in QuickBooks.

Financial Accounting Limitation #2: It’s Not Real-Time

Second, financial accounting isn’t real-time. Income statements and balance sheets can be compiled on a monthly basis, but that’s not very useful when you want to rapidly uncover and act on new information—sometimes at an intraday level. And because of the complex and dynamic nature of the Amazon marketplace, it is imperative to gather information in real-time and make decisions based on that information quickly.

The way to close this gap is by leveraging managerial accounting, and that’s what we’ll talk about next.

What Is Managerial Accounting?

Managerial accounting is a discipline focused on supplying a company’s internal management with the information they need to control the business and make timely, effective decisions. Any managerial accounting solution will by definition be tailored to a specific business domain, because every industry is unique in many ways, and requires specialized features and analytics to be useful for the management. As a result, managerial accounting is actually an excellent complement to financial accounting. The former can provide real-time, micro-level business intelligence that is highly specific to the Amazon marketplace, while the latter generates standardized financial statements that paint a high-level picture of the health of the business, and are instrumental for interfacing with outside stakeholders and filing taxes.

How to Get Started with a Managerial Accounting System

When it comes to selecting a managerial accounting system for your Amazon business, it’s crucial to remember that a good product is a focused product.

Because marketplace accounting and financial management are inherently difficult, a good Amazon-centric managerial accounting system has to be focused on this single problem domain, instead of trying to be everything for everyone. Just like activities like inventory management, financial accounting, and marketing automation have their own dedicated software solutions, managerial accounting for Amazon sellers requires a specialized system that does a limited number of things extremely well. It can’t be an after-thought feature.

With that in mind, we wanted to outline several specific areas of managerial accounting for Amazon merchants. We also want to highlight some of the tools available to assist merchants in these areas, including a system we developed called Sellerscale.

Managerial Accounting Function #1: Real-Time Performance Monitoring

Having access to timely, accurate information about the performance of your Amazon channel isn’t just an advantage—it’s a survival requirement. Given the intense competition, inherent platform risks, and thin margins, you have to stay on top of your sales and profitability metrics at all times. And because Seller Central doesn’t have your cost-of-goods-sold data or a centralized interface showing aggregate performance metrics, your best bet is to use a third-party tool. Below we briefly go over several available options: Fetcher, HelloProfit, and Sellerscale (our product).

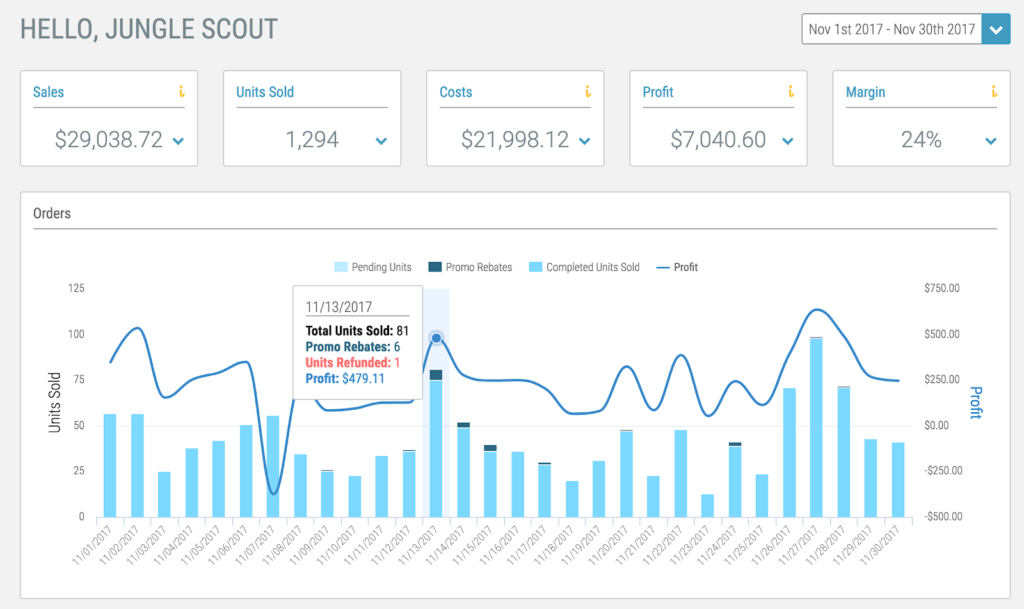

Real-Time Performance Monitoring with Fetcher

Fetcher’s dashboard is a good option for keeping track of your high-level metrics. The one limitation is that there is no product selector to easily toggle between different SKUs, and no option to group product data by time period or by parent ASIN. To view product-specific metrics, you’ll need to navigate to a different tab in the tool.

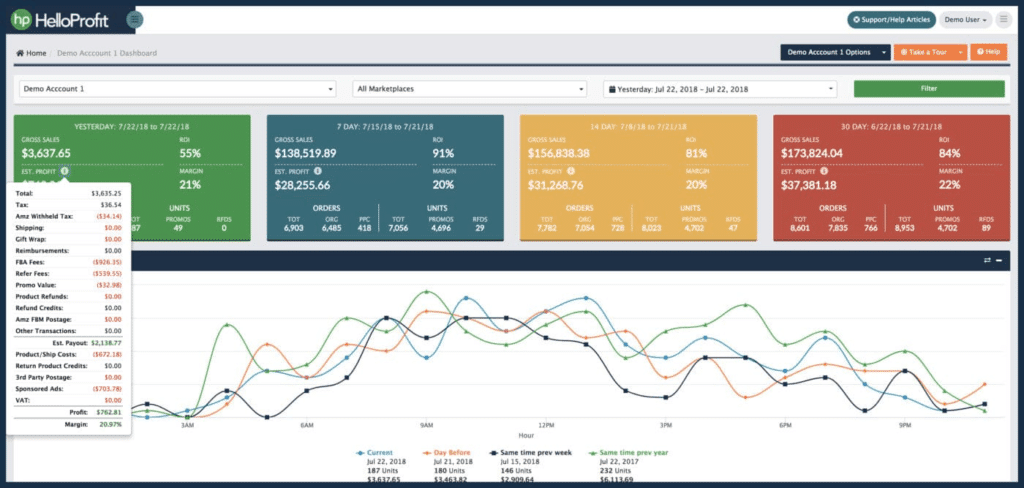

Real-Time Performance Monitoring with HelloProfit

HelloProfit is another popular tool that provides a performance dashboard. HelloProfit displays a great deal of information, filtering options, and side-by-side data across different time periods in its dashboard. While some people might find this presentation convenient, one potential drawback with this UI is that it tends to overload the user with information, potentially causing cognitive fatigue as they are forced to differentiate signal from noise every time they open the app.

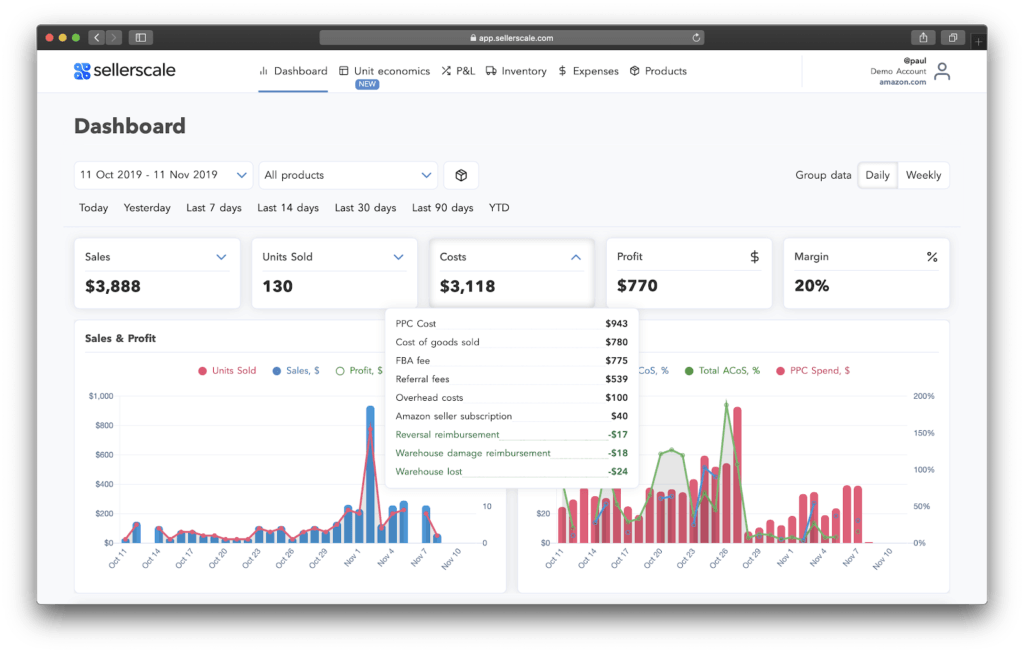

Real-Time Performance Monitoring with Sellerscale

When building Sellerscale’s performance dashboard, our goal was to quickly and efficiently give the user an overview of the health of their business and individual SKUs. This pushed us to minimize the number of clicks and mental decisions involved in order to conserve the user’s cognitive bandwidth. We also wanted to prioritize interface design so that the dashboard was not only functional but also aesthetically pleasing.

Managerial Accounting Function #2: Unit Economics Analysis

Another powerful tool managers can use to make better business decisions is unit economics analysis. By dissecting the unit economics of any given product, you can understand its average profitability for every sold unit, as well as learn how various profitability drivers affect its margin, ROI, and payback period.

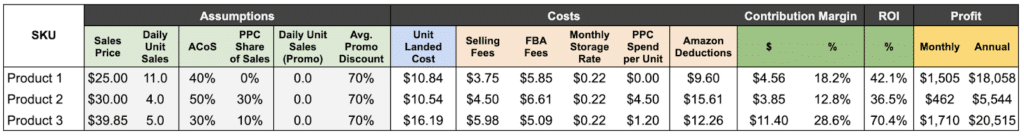

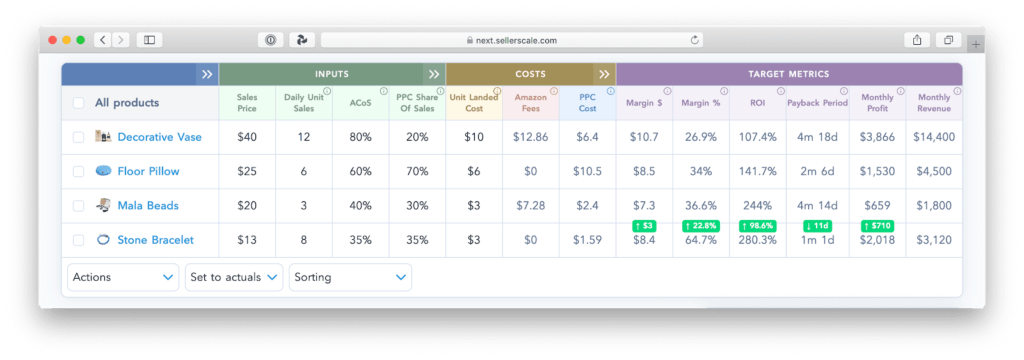

One way to analyze your unit economics is with a spreadsheet like this one:

This model can help you get a better sense of your unit-level profitability, and study the effects of different input assumptions on your contribution margin and other target metrics. This can be done both for existing products, as well as potential new ones.

While Excel is a great universal tool, it’s hard to integrate spreadsheets with Amazon’s API. As a result, you’ll need to update all the numbers manually, which can take a lot of effort and introduce errors into your calculations. Having experienced this problem directly, we decided to turn our Excel-based unit economics model into a web application that automatically pulls data from Amazon and lets the user manipulate it in useful ways.

This unit economics tool lets you see current unit-level profitability for each SKU, easily calculate breakeven price/ACoS, and simulate an infinite number of financial scenarios in order to understand how profitability would change under different conditions.

This kind of sensitivity analysis is important, because in order to make smart capital allocation decisions, it helps to understand how key profitability drivers (sales price, ACoS, share of organic sales, etc.) affect your margin, ROI, and payback period. It also allows you to test various assumptions to ensure that your unit economics are attractive across a broad range of scenarios.

Here are a few examples of important questions you can answer using sensitivity analysis:

- If I price in line with competitor products, how efficient does my advertising have to be to generate an acceptable margin/ROI?

- What will my ROI and payback period be at different price points, ACoS levels, and sales velocities?

- What are my breakeven price and ACoS under different conditions?

- If I run a Y% discount on X units per day, how will my average unit-level profitability change?

- How would a $1 reduction in unit landed cost impact ROI and other KPIs?

- Out of the 10 potential new products we could launch, which ones are likely to have the best economics across a range of possible scenarios (different price points, ad efficiency, etc.)

Managerial Accounting Function #3: Inventory Management

Needless to say, e-commerce inventory management can get hugely complex, and it often requires a dedicated solution. That said, a good managerial accounting platform needs to at a minimum provide basic stock level monitoring and replenishment planning capability.

Inventory Management with Fetcher

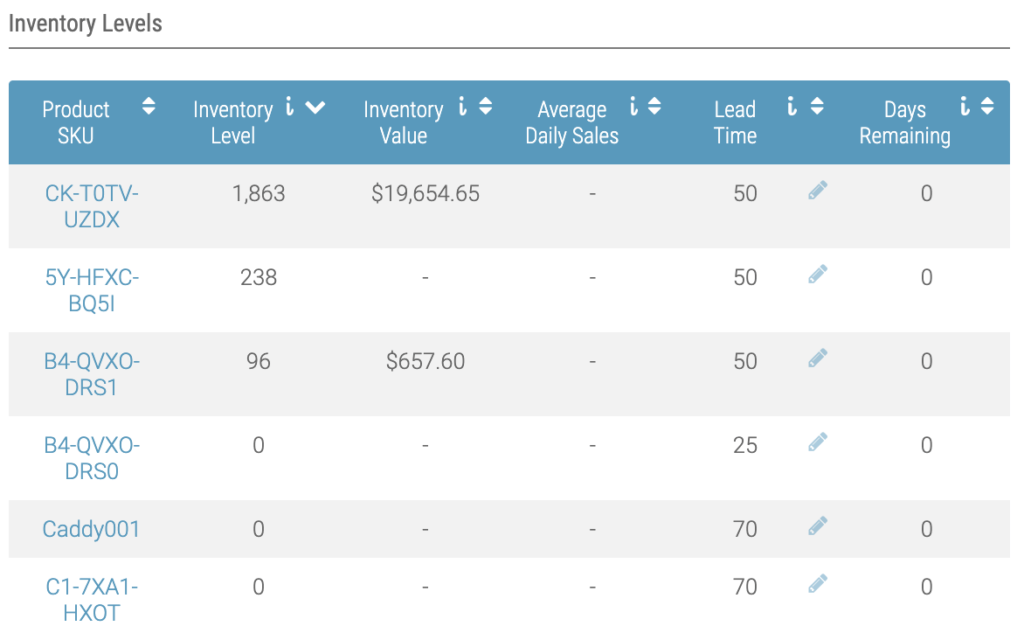

Fetcher has an inventory widget on the dashboard that tracks inventory levels for each SKU and provides an estimated “days remaining” metric.

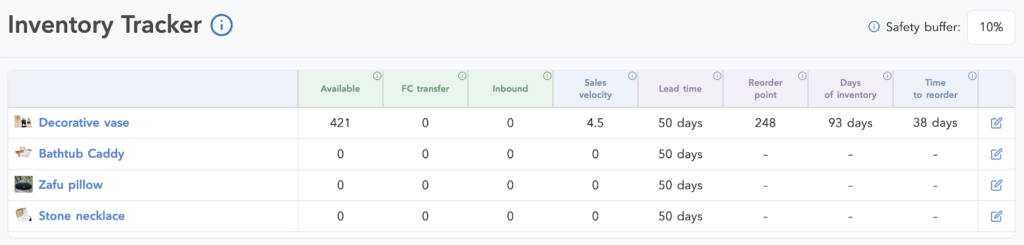

Inventory Management with Sellerscale

Sellerscale’s inventory tool provides a bit more granularity, and also lets you specify a “safety buffer” percentage in order to reduce the probability that a stockout will occur.

A simple inventory tracker like this by no means replaces a dedicated inventory management system such as Skubana, but it can be valuable as a quick way to monitor stock levels, days of remaining inventory, and upcoming replenishment needs.

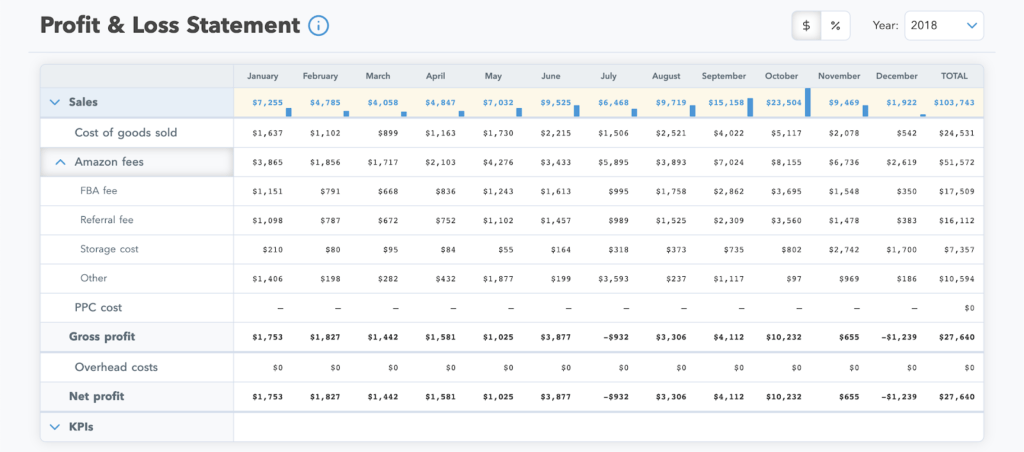

Managerial Accounting Function #4: P&L Reporting and Expense Tracking

The goal of managerial accounting is to supply business managers with real-time, domain-specific information to aid in decision-making. The P&L statement is a key document that delivers this kind of actionable intelligence. And in order to provide a complete picture of business financials, it obviously has to include overhead expenses that can only be entered into the system manually.

P&L Reporting and Expense Tracking with Fetcher

In Fetcher, there’s a P&L report that looks like this:

P&L Reporting and Expense Tracking with Sellerscale

Sellerscale has a similar P&L tool, but one of the additional features we’ve added is the ability to switch the report into a percentage format, where revenue is expressed as 100% and all other items are shown as a percentage of revenue (this is called a “common size financial statement”).

Both products also have expense trackers for quickly creating one-time and recurring overhead expenses, which then get accounted for in all historical reporting.

Take the Next Step Toward Greater Control and Profitability

Holistic financial management requires both financial and managerial accounting. The significant complexity of the Amazon Marketplace makes real-time performance monitoring and unit economics analysis even more critical. This is especially true when Amazon isn’t your only distribution channel, and you need to ensure it fits into your broader strategy and justifies the opportunity cost involved. There are a number of options when it comes to managerial accounting software, and it’s important that the platform you choose is a high-quality product that will evolve and scale with your Amazon operation.

And just as important as the solution you choose is the way you implement it and act on the data and insights it provides for your business. If you need creating, implementing, and maximizing a managerial accounting framework for your Amazon business, consider working with an agency that’s done this at the highest level for some of Amazon’s most successful brands.

If you’re one of the estimated 20%–40% of brands who fire their agency annually, you can’t focus on that vision if you have to keep searching for the right support. BBE proudly retained >95% of our clients last year while applying focused dedication to our brand partners. If you’re ready to start over for the last time, contact us and find out why leading brands have partnered with us for so long.