Q4 is nearly upon us! With so many retailer sales events happening through the end of the year, we want to ensure that you are prepared. The level of planning, logistics, and execution for sales events like Prime Day in Q3, took a LOT of coordinated effort. Whether you are a growing brand or a category incumbent, the decision to participate in a retail sales event is a strategic one that takes consideration, analysis, and orchestrated effort across multiple parts of a business. By and large, it is a huge investment of time, effort, and money on the part of brands. While there seem to be intrinsic benefits to participating in events such as Prime Day, we can’t help but wonder…

Is it worth it?

With multiple upcoming retailer sales events throughout Q4, including what is believed to be a second Prime Day, we want to explore both sides of this argument for and against retailer sales events. So before we all give ourselves a pat on the back for our recent Prime Day success this summer, let’s take a deep breath and explore this paradox.

What makes a “successful” Prime Day?

The sales event that kicked off with early deals starting June 21 offered “… some of our best Prime Day deals yet…” according to Jamil Ghani, vice president of Amazon Prime. According to the Amazon Prime Day Press Release, Prime members purchased more than 300 million items worldwide during Prime Day 2022, making this year’s event the biggest Prime Day event in Amazon’s history.

When we see such massive numbers posted by Amazon and phrases like “biggest Prime Day event in Amazon’s history,” we have to wonder, was our Prime Day event as much of a success?

In our post-Prime Day analysis, we have assessed sales velocity, advertising returns, earned media, and more. The more we look at the numbers from our years of participation in Prime Day, the more we see the sales event shifting from premium brands offering deals on quality products to a lot of competing brands vying for advertising space while top placements for sales and conversion seem to be focused on Amazon products. With concern over how consumers are spending their money as we move towards a recessionary economy, we know that we will have to be more judicious in engaging consumers with our marketing budget and ensure that we are offering quality products at great prices while still conserving our margins. In this sense, consumer shopping habits are changing.

“We saw a larger-than-usual increase in CPG and grocery on Prime Day as customers were looking for deals on everyday items.”— Liz Adamson, Buy Box Experts’s Chief Client Services Officer

While Amazon is busy counting its ad revenue profits and newly minted Prime Membership subscriptions in the wake of the Prime Day aftermath, many of us are still wondering…was it worth it? This causes us to take a step back and see a trend we can’t ignore.

A trend of “not playing the game”

Prime Day was once heralded as the event of the season and helped bolster sales in a traditional summer slump, and it had become a mainstay in the shopper psyche, garnering the attention of myriad retailers jumping on the midsummer deal bandwagon. Over the last number of years, we have seen an ever-increasing trend of brands choosing to opt-out of participation in Prime Day.

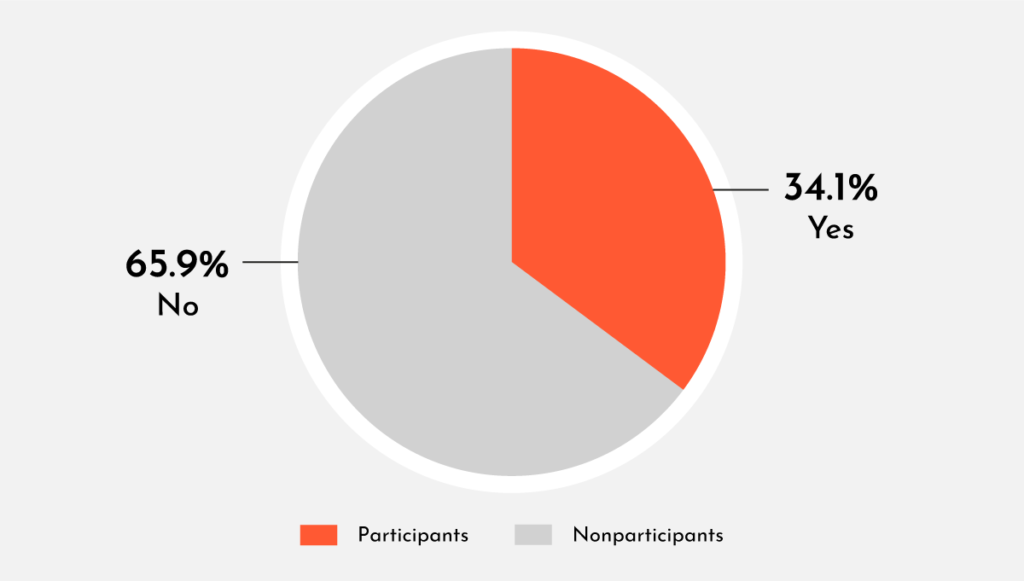

Of the brands measured by BBE, 65.9% of brands opted out of participating in Prime Day in the summer of 2022, choosing not to run Prime Day–exclusive deals or excessive ad placements through the event. Instead, they opted for a strategy to take advantage of pre- and post-event traffic where competition and CPCs were minimized.

While many brands still have very effective sales velocity over Prime Day and benefit from the increased traffic and conversion from shoppers, the secondary effects of the event—such as repeat purchases and new-to-brand long-term sales increase—are still unclear.

Over the next three articles, we will explore:

- The benefits of Prime Day (whether they are actually benefits)

- The hidden costs of participation (what the bottom line is)

- Questions brand owners/investors need to ask as they seek to participate in retailer sales events