Latin America is the world’s fastest-growing region in terms of ecommerce. With an expected growth rate of 19% in the next five years (compared to 11% in the rest of the world), the region’s ecommerce market could be as large as $118 billion by 2021.

In Brazil alone, online sales are expected to hit $21.3 billion this year, and rise to over $31 billion by 2022. But other countries in the region are experiencing an ecommerce boom too, including Argentina, Mexico, Chile, and Colombia. With an expected 163 million ecommerce users by 2021, the region is poised for continued growth.

But at the same time, ecommerce in Latin America faces some serious challenges.

Latin American ecommerce: the players

First, let’s cover the major ecommerce players in the region.

MercadoLibre

MercadoLibre is by far the ecommerce leader in Latin America, having built their entire business on helping merchants sell products to customers all over Latin America. The Argentina-based marketplace saw 56.3 million unique desktop visitors during May 2018.

The company offers six integrated e-commerce services: the MercadoLibre Marketplace, the MercadoLibre Classifieds Service, the MercadoPago payments solution, the MercadoEnvios shipping service, the MercadoLibre advertising program, and the MercadoShops online webstores solution. In recent months MercadoPago has been rolled out to more regions to generate additional revenue.

(Source: Seeking Alpha)

Linio/Falabella

Linio was launched in 2012 by Berlin-based ecommerce incubator Rocket Internet to complement its clothing business, Dafiti. Linio claims to be the largest ecommerce business in Latin America, with a reported 50 million visitors per month, but there are few public sources of information to back up that claim.

Most reports suggest Linio operates one of the largest marketplace platforms in the region, with more than six million products across 60 categories via a network of over 27,000 professional sellers. The company has raised $230.5 million in funding so far, with $55 million in private equity funding in September 2016, but has not provided revenue information.

In August 2018, Linio was acquired by Chilean retailer Falabella for $138 million, in an attempt to take on Amazon, MercadoLibre, and others in the Latin American market.

Amazon

Amazon operates in Mexico and Brazil. The Brazil business only serviced Kindle-related products (e-readers, books, and streaming movies) until October 2017, when Amazon opened a third-party marketplace, primarily to sell electronics, which are in high demand in Brazil. And in August 2018, Amazon started selling sportswear and fashion items in the country, although these products are also still fulfilled by third-party sellers and not Amazon directly.

The challenges for Latin American ecommerce

Ecommerce in Latin America faces two key challenges that present an uphill battle for both marketplaces and consumers in the region: logistics and payments.

Challenge #1: Logistics

Logistics in Latin America is a huge challenge for ecommerce marketplaces, due to a lack of end-to-end responsibility for purchases. Customs delays and corruption present a huge challenge for cross-border purchases in the region, according to Americas Market Intelligence. This is one of the reasons why Chinese ecommerce giant Alibaba’s AliExpress platform is gaining market share in Latin America as it allows customers to purchase two lower-value items in the hopes that one of them will outwit the region’s logistics inefficiencies and make it to their door.

In 2015 Americas Market Intelligence (AMI) conducted a mystery shopping exercise for a leading logistics company in which packages were delivered across all continents using several logistics firms. In Asia, Europe and North America, packages arrived within two to five days as predicted but in Latin America all parcels encountered obstacles at customs. In Argentina, customs officials requested a bribe to expedite the clearing of the packages. While in Colombia and Mexico, local authorities did not clear the goods arguing the receiver must be a registered importer (in itself a time-consuming process) prior to delivery and refused to release the package.

Challenge #2: Payments

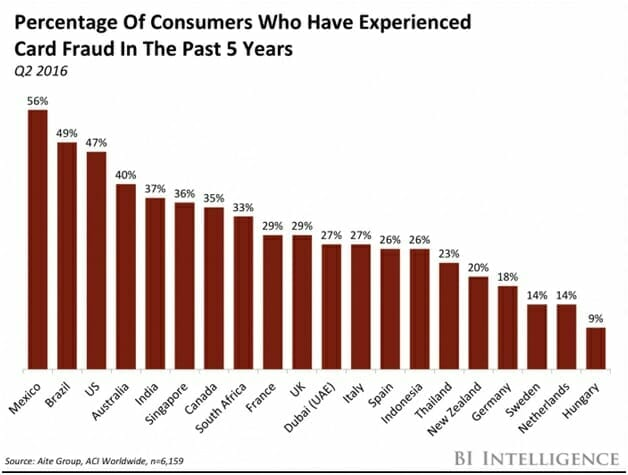

In most Latin American countries, customers are wary of product quality and uncertain if their products will even be delivered, as discussed above. This, combined with low credit card penetration, leads to significant challenges for ecommerce marketplaces. Credit and debit card fraud rates in Mexico and Brazil are the highest in the world, making customer trepidation about using cards to purchase goods online in these countries understandable.

As a result, some marketplaces have instituted workarounds and alternative payment options. This challenge is solved by some online retailers in Mexico and Argentina by offering cash on delivery as a payment method. Meanwhile, in Brazil, merchants can apply online for the boleto bancário, a printable, bar-coded invoice that can be paid by consumers online or offline—from EBANX, an ecommerce payment provider. And in late 2015, Amazon began selling gift cards at thousands of Oxxo convenience stores in Mexico to access cash-paying consumers. Linio, another e-commerce marketplace company in Latin America, also allows Mexican shoppers to pay by cash on delivery or at an Oxxo retail location.

The brand point of view on Latin American ecommerce

Brands that are considering entering the Latin American ecommerce market must do their homework on payment and logistics options, as the challenges these markets poses provide the potential for resource drain despite the significant possibility of growth.

If you’re comfortable tackling these challenges and considering entering the Latin American market, a logical option would be to start with Mexico as a test bed before moving deeper into the market. Mexico is close to the US market and operates on similar time zones. Keep in mind that investment will be required to translating product content into Portuguese and/or Spanish and to leverage customer support in the local language.

If you’re one of the estimated 20%–40% of brands who fire their agency annually, you can’t focus on that vision if you have to keep searching for the right support. BBE proudly retained >95% of our clients last year while applying focused dedication to our brand partners. If you’re ready to start over for the last time, contact us and find out why leading brands have partnered with us for so long.