Since its founding in 1996 by Jeff Bezos, Amazon has become a powerhouse in the US ecommerce market. After establishing a foothold in the leading English speaking ecommerce markets, it has looked to the rest of the world, particularly in the past five years, to spread its retail dominance to new regions.

This continued international expansion is key to Amazon’s continued success—but it faces significant hurdles along the way.

Amazon’s ambitious foray into international markets

Amazon’s designs on international markets are no secret, and the company has moved aggressively to widen its footprint across the globe in recent years. Amazon has used a simple strategy to go into new markets: enter countries that are growing quickly in terms of ecommerce adoption as a percentage of total retail.

In the past three years, the launch strategy used by Amazon in several countries has been based around its Kindle business. Typically, Amazon starts by negotiating with local book publishers. Then, once the parties reach an agreement, Amazon starts selling Kindles and ebooks as a way to get its foot in the door.

This was the strategy Amazon followed when it entered the Brazilian market in Q2 of 2012, after finalizing deals with local publishers to sell ebooks. Since then, it’s attempted to cement its position in the country’s ecommerce industry, attempting to woo cosmetics manufacturers in the country and looking to lease a warehouse facility near Sao Paulo earlier this year.

In mid-2015, Amazon launched its physical goods business in Mexico which, like Brazil, is a developing but fast-growing ecommerce market. After opening a Kindle Store for Mexican customers in 2013, Amazon launched a physical goods store on the Spanish-language site Amazon.com.mx, offering millions of unique items to customers in the country.

In 2017, Amazon launched in Singapore, perhaps its most aggressive foray into a new location in the past five years. Rather than use the Kindle store as a point of entry, the company used their Amazon Prime Now mobile app as an entry point to leverage the mobile-first nature of the Singapore market. Amazon Singapore offers Prime Now two-hour delivery service on a huge range of items.

Then, after opening a fulfillment center and meeting with suppliers, Amazon launched their business in Australia in December 2017.

In addition to entering Brazil, Mexico, Singapore, and Australia, in 2017, Amazon also acquired a marketplace in a region in which they did not have an official business presence. By purchasing ecommerce firm Souq for $580 million—sensing an opportunity to acquire the Middle East’s biggest marketplace more cheaply than starting an entirely new business in the region—it has become the Middle Eastern market leader in an indirect manner.

In all cases Amazon, launches in a new location, gains market share by undercutting local competitors. Once they’ve acquired a large number of local customers and third-party sellers, they start marketing Amazon devices and placing greater emphasis on Amazon Prime memberships. It’s not about becoming profitable, but rather generating revenue that can be used for reinvestment, as well as gaining new Prime members—who, as we’ll see, are a crucial piece of the puzzle.

Why is Amazon going international?

But why has Amazon been so determined to go international? Quite simply, because growth in North America, particularly among Prime customers, has been slowing.

According to Business Insider in May 2017, Amazon Prime has been “reaching saturation in the US,” as roughly 65 percent of US households have Prime memberships. “Although there is still room for Amazon to expand Prime in its domestic market,” says Business Insider, “growth is likely to slow significantly as more of the population joins the membership program.”

Prime is one of Amazon’s largest lever for driving recurring revenue from its customers. It is well known that Prime customers spend more ($1,300 per year) than non-members ($700 per year), which is why augmenting the ranks of the former is one of Amazon’s key reasons for international expansion.

Prime memberships are ultimately the long-term growth driver for Amazon, so being able to offer Prime to more new markets ensures that Amazon can leverage customer loyalty and drive spending at a much larger scale, extracting more recurring revenue to offset investment costs.

Thus, although Amazon has a dominant position in many developed markets (particularly the US, the UK, and Germany), to ensure revenue creation can be done at a reasonable rate, it needs to keep growing internationally.

Amazon’s international expansion hasn’t been smooth sailing

While this rationale may be sound, Amazon’s international expansion has not been without challenges. Amazon sells many products at razor-thin margins, and profitability has always been a challenge. As Amazon adds new locations, it adds even more financial pressure to its balance sheet, balanced by the hope that the company can sell lots of Prime memberships and Amazon-created hardware (Alexas, Kindles, and other devices)—which, while also low-margin, can drive loyalty toward the marketplace and incentivize purchases of high-margin goods such as digital downloads.

Amazon itself has admitted that profitability is not its primary aim with its international excursions:

“Our international activities are significant to our revenues and profits, and we plan to further expand internationally. In certain international market segments, we have relatively little operating experience and may not benefit from any first-to-market advantages or otherwise succeed. It is costly to establish, develop, and maintain international operations and websites, and promote our brand internationally. Our international operations may not be profitable on a sustained basis.”

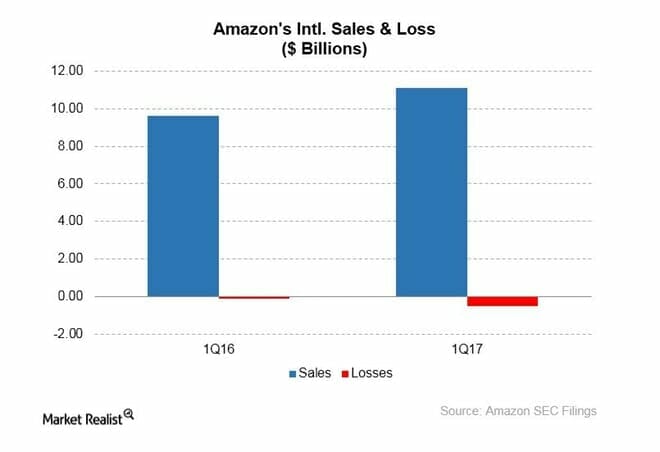

(Source: Market Realist)

Instead, Amazon has adopted a landgrab attitude in which it wants to own the entire ecosystem (marketplace, new customers, etc.) instead of partnering with a local marketplace. And by moving into fast-growing developing markets such as Singapore and India (where it’s been since 2013), Amazon is hoping to tap new customers who in the long run will contribute to revenue creation.

But some of these emerging markets have presented problems (both logistical and cultural) that have forced Amazon to invest significantly before generating any revenue—and these challenges have borne out in the data.

(Source: Seeking Alpha)

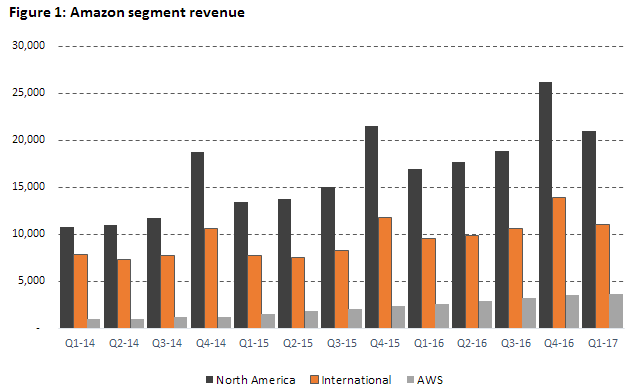

As the graph above shows, Amazon’s international revenue has not grown at the same consistent rate that’s been seen in North America. While Amazon has invested heavily in its international business, the return generated so far has simply not been on the same level as its US operation.

Indeed, as Quartz has reported, Amazon is “struggling to duplicate its US success overseas.” Despite its active presence in the country since 2012, Amazon is still ''playing catch-up'' in Brazil as local competitors like Magazine Luiza, B2W Cia Digital, and MercadoLibre have succeeded by copying elements of Amazon’s own playbook.

But it’s in one of Amazon’s oldest international marketplaces that it faces perhaps its largest ongoing threat: China, where juggernaut Alibaba still reigns supreme. Amazon has a small presence in China and has recently started using Alibaba properties to gain market share, but it faces an uphill climb.

While Alibaba has been Amazon’s main hurdle to ecommerce dominance in China, it has, like Amazon, been looking to grow its international business to supplement its dominance in the local market. Amazon also sells products to customers around the world via Global Selling, a cross-border operation to ensure that many non-Prime customers are able to purchase books, games, and other goods via the Amazon.com website. Alibaba uses a similar model, though it does not own or operate logistics and warehouses in China.

Nonetheless, despite the uphill battle Amazon faces, international markets are too crucial too ignore if the company wants to continue to grow. While it could be argued that the company is spreading itself thin trying to dominate so many new markets in such a short period of time, shrewd observers would surely note that Amazon should never be counted out.

Brands: What to do?

Amazon provides brands tools and access to new customers in markets outside their core location of operation. Amazon’s international marketplaces present a huge opportunity to grow your business, but this opportunity also warrants careful consideration and a logical, risk-minded approach. Brands looking to strike out internationally may do well to start with an international market that is physically proximal, that operates in a similar time zone, or that contains a large number of customers who have previously purchased items from them.

In the long run, not leveraging cross-border ecommerce will hurt your business as competitors, unauthorized resellers, and other opportunistic, forward-thinking businesses slowly test and eventually dominate markets in which your brand has no presence.

If you’re one of the estimated 20%–40% of brands who fire their agency annually, you can’t focus on that vision if you have to keep searching for the right support. BBE proudly retained >95% of our clients last year while applying focused dedication to our brand partners. If you’re ready to start over for the last time, contact us and find out why leading brands have partnered with us for so long.